Running your family office

Finance, Operation & Lifestyle Management – Your Family C-Suite

Enjoy the exclusive experience of a single family office while benefiting from the depth of expertise of a multi-family office

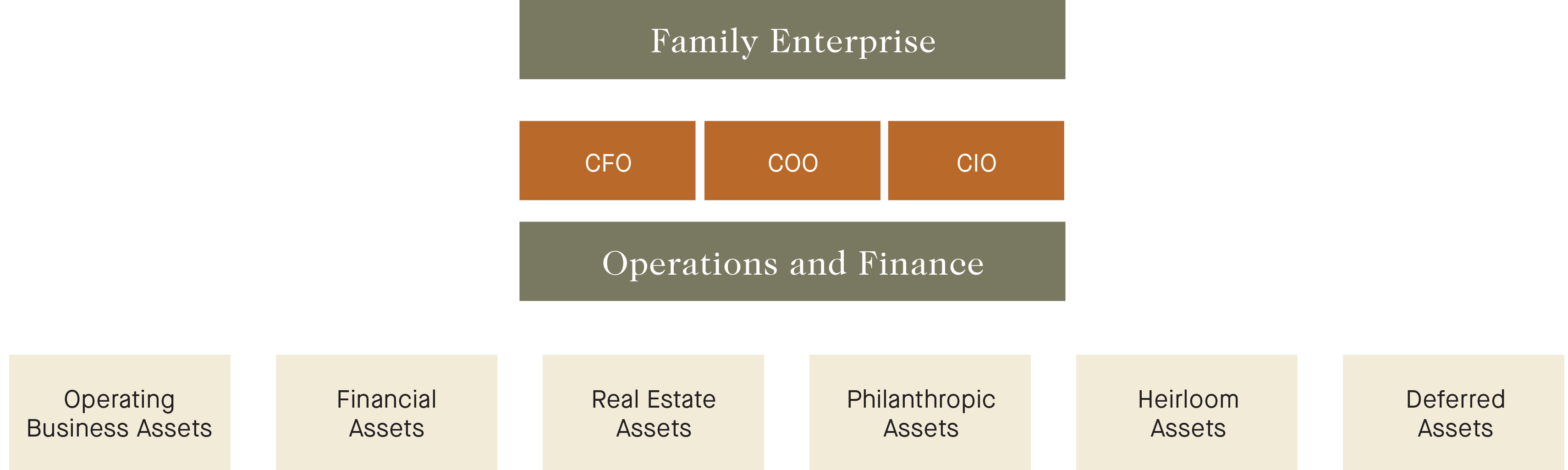

The interests of a family go beyond business interests, and this is commonly referred to as the family enterprise. This broad range of assets requires the same level of oversight and diligence as a well-run operating business.

Ultra-high-net-worth families need a strategy – guided by experienced professionals – that aligns their goals, family values, and business interests to facilitate the alignment of their enterprise and family unit.

When designing your family office solution, the roles and responsibilities of your C-Suite team are established and well defined, along with a proper support system. Typically, a family office solution is composed of a Chief Investment Officer (CIO), a Chief Financial Officer (CFO), a Chief Operating Officer (COO) and in some instances, a Chief Experience Officer (CXO). We ensure a seamless integration of those various roles, working with external advisors and the family’s internal team to align the goals and objectives of the family.

Chief Investment Officer

Combining asset and wealth management, bespoke investment strategies, detailed due diligence and consolidated reports, RFO Capital Inc. is well positioned to offer multi-generational families an array of financial advisory services tailored to their unique situation and objectives.

Our Chief Executive Team

Whether you are working with your Chief Financial Officer (CFO), your Chief Operating Officer (COO) or your Chief Experience Officer (CXO), the full team is an integral part of your family office. Your CFO and COO ensure that all financial matters are in line with the family’s values, goals, and objectives. Your CFO and COO handle strategic and foundational matters, including investment accounting, cash management, operations, finance, and reporting of the family office. Your CFO and COO also oversee the overall family office management and act as the main points of contact among the various advisors. Your CXO is here to assist you in various ways. Do you need restaurant reservations? Bookings for vacations? Arranging a tutor for your children? Do you need to find the perfect contractor for cottage renovations? Picking the perfect gift for an art enthusiast? Your CXO can help alleviate some of the more administrative and time-consuming items on your list – so you can focus on more important tasks with peace of mind.

With in-depth expertise and broader perspective in all areas, Richter’s professionals can help fine-tune your financial journey, while taking care of the details along the way. With Richter as your family C-Suite, you can reclaim the luxuries of time and peace of mind.

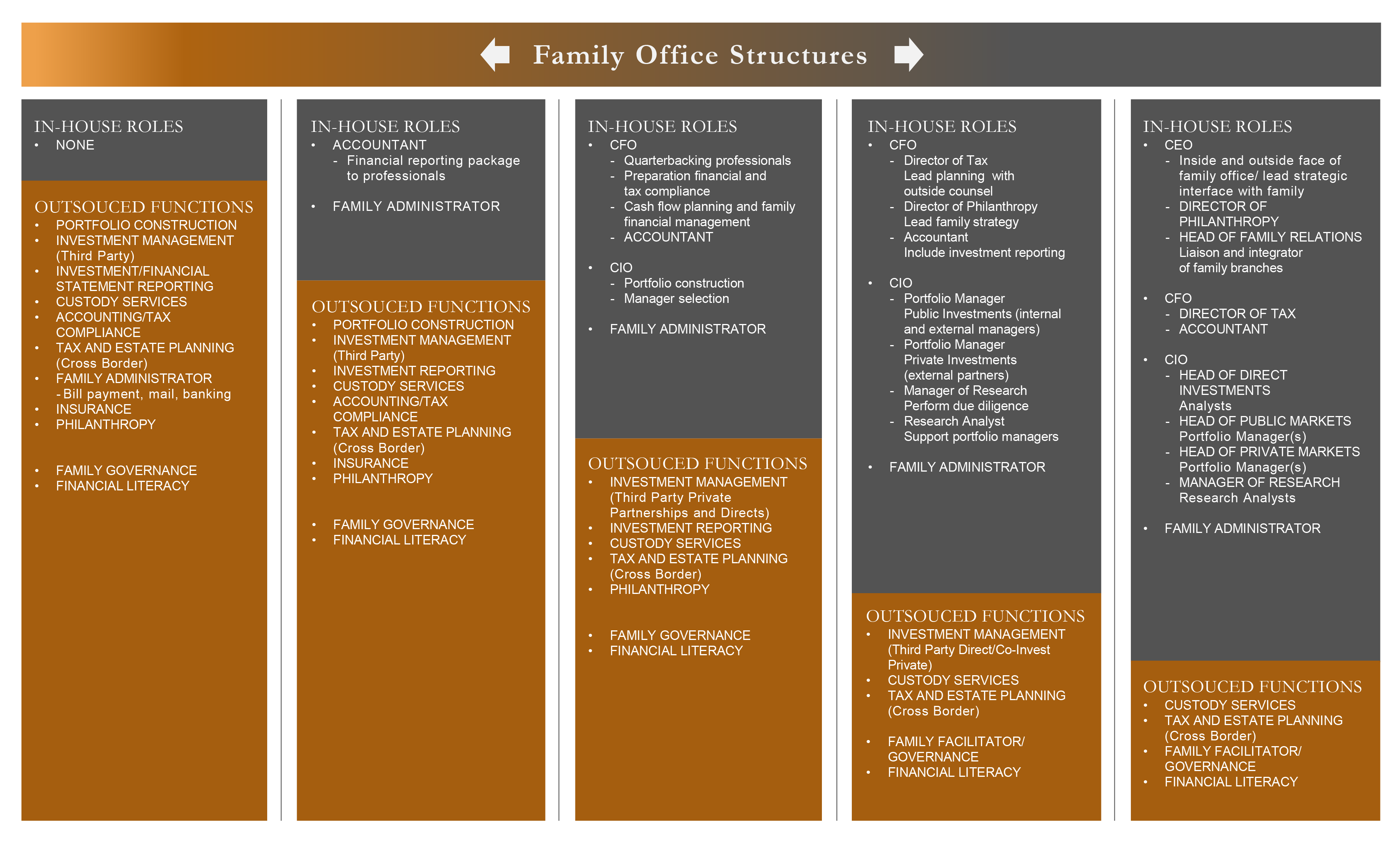

A customized approach tailored to your specific needs

From offering all services to you and your family, to a very tailored and specific approach, we will design your state-or-the-art family office platform so you can meet your financial goals and build intergenerational success.

RELATED INSIGHTS

Discover more insights

MANAGING MY FINANCES WITH A PERSONAL CHIEF FINANCIAL OFFICER

Managing multiple bank accounts and portfolios, intricate legal structures, complicated compliance requirements, and navigating how to transfer your wealth to your children in a tax-efficient manner… managing personal finances can be exhausting.

Does your family need a Chief Investment Officer?

At the heart of your family’s financial matters: your personal CFO

As well as being time consuming, financial affairs come with unique challenges. Having to manage multiple bank accounts …