Navigating Family Dynamics – Governance

Navigating family dynamics means ensuring that the emotional factors that influence a family’s decision making are given attention that’s equal to that of how their financial picture is composed. This is about identifying a family’s objectives and core values and working together to achieve their goals guided by their principles.

At Richter Family Office, our work is not just focused around the financial wealth, it’s about getting to know the people at the centre of all the numbers, issues, and assets. Our job is to participate in the whole story, not just one narrative. To begin this journey of understanding the family dynamics at the heart of each story, there are two important chapters: family governance and education.

“There’s a lot of value in telling the family history. In most cases this wealth was not created suddenly. By describing that journey of how the business started, grew, and encountered difficulties, the patriarch and matriarch can explain how they managed both the company and the family. There’s a lot of learning for the next generation there,” explains Mindy Mayman, Partner, Richter Family Office.

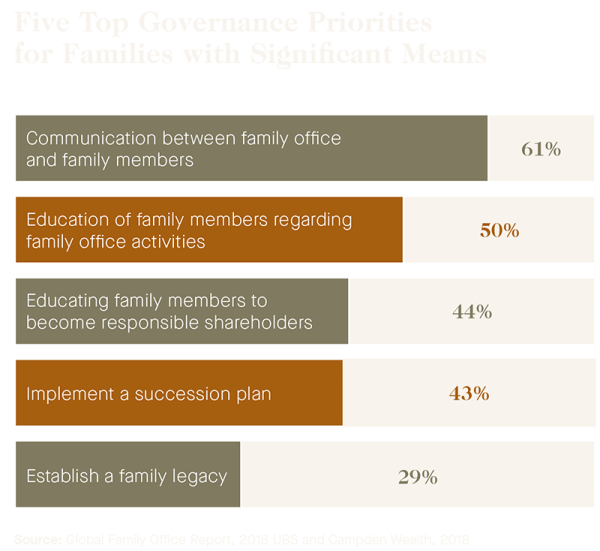

The UBS and Campden Wealth Global Family Office Report 2018 identified five top governance priorities for families of significant means. They are:

Family Governance: A Priority

Governance is a key component that allows a framework for open communication among family members and forms the basis of trust and respect.

For most families, proper governance is the basis for a successful legacy. A good governance framework helps ensure that each member is supported in their quest to succeed. Helping lay the foundation for future family members to be their own wealth creators – be that financial, intellectual, or social wealth – and provides members with a purpose and builds self-esteem. It also helps encourage harmony with the family unit.

Family enterprises are complex systems, whether their structure includes an operating family business or stakeholders in a large passive investment corporation. It’s in this environment that the intersection between financial wealth and family intersect, and conflict can arise. Having worked with generations of enterprise families through their own unique generational transitions, we recognize the importance of having proper continuity planning in place to ensure that all stakeholders can have a voice in the stewardship of their family’s legacy.

Working to develop a governance system that addresses the root causes of entitlement and self-righteousness means setting the stage for wealth accumulation across generations and seeks to break the curse of “shirtsleeves to shirtsleeves in three generations.”

Financial Education

Financial education is key to building confidence in young or new family members and the Next Gen. Preparedness means being able to make sound investment decisions and provides the foundation upon which families can ensure a lasting legacy. Richter Family Office takes the time to educate its clients and their children to ensure that they are empowered to understand the complexities of their wealth and have the capacity to make well-informed decisions in their own right. As part of its commitment in this area, Richter Family Office has created a bespoke program for our families to provide them with a deeper understanding in the areas of:

- Investment management and financial markets

- Financial planning and cash management

- Financial statement analysis

- Tax planning and structuring

- Basic legal concepts and frameworks

- Philanthropy

- Family governance and values

Successful multi-generational wealth transfer is not simply about the tax efficient transition of wealth, but also the transition of knowledge and family values. Richter’s Financial Literacy Program can help ensure your Next Generation is prepared, confident and ready to become wealth creators in their own right.

KEY EXPERTS

View allRELATED INSIGHTS

Discover more insights

Succession planning: How can millennials prepare for the family business?

The family business is a source of pride. It’s a legacy; it’s …

Continuity Planning: A Trusted Advisor Is Key

Twenty years ago, our vision for this family office was to create a truly independent and objective wealth advisory model …