U.S. Tax Filing Obligations for Expatriates

Carey Singer and Michel Oulimar

Understatement alert: filing taxes can be complicated. This year especially, is no exception. If you are a U.S. citizen living in Canada but filing in the U.S., our U.S. Tax professionals have outlined the basics for you. As always though, it is best to consult a professional to determine the needs of your situation.

WHAT DO YOU NEED TO FILE?

U.S. citizens in Canada are required to file the following on an annual basis:

- Federal Income tax return;

- FBAR Reports to disclose certain foreign financial information;

- Form 5471 to report ownership of certain foreign corporations (if applicable);

- Forms 3520 and 3520-A for ownership of and/or distributions from a foreign trust;

- Form 8938 to report certain financial accounts (if applicable);

- Form 8621 to report an interest in a PFIC (if applicable);

- Revenue Procedure 2020-17 and Revenue Bulletin 2020-12 provide exceptions to the Forms 3520 and 3520-A filing requirements.

WHAT’S IN AND WHAT’S NOT?

- RESPs are now exempt from these filings;

- TFSAs are not exempt.

DON’T FORGET:

- Penalties that can be levied on the non-filing of tax returns and information returns. The penalties for failure to file certain information returns can be significant.

- Tax filing requirements also vary at the state level. It’s best to confirm with a professional what is required for the state you are filing in, specifically.

- Estate Taxes are applicable to estates greater than $11.5M indexed for inflation, at the rate of 18% to 40%

AMNESTY PROGRAMS

STREAMLINED PROCEDURE:

- File past 3 years of income tax returns, including information returns such as 5471’s, 3520’s, 8938’s;

- File past 6 years of FBAR Reports;

- Sworn statement that omission was not willful;

- Must not have been contacted by IRS for these years prior to submission;

- Must pay outstanding tax and interest, no penalties.

RELINQUISH CITIZENSHIP

- Formally renounce citizenship;

- File 5 years of tax returns and 6 years of FBARs;

- Pay tax and interest, no penalties;

- Only qualify if less than $25K of tax is owed in total.

ADDRESSING COVID-19

CARES ACT FOR INDIVIDUALS

The Coronavirus Aid, Relief, and Economic Security Act, or CARES Act, addresses the economic impacts of COVID-19. Most measures also apply to U.S citizens living abroad. The relief package is at $2 trillion and includes the following:

- 2019 tax return filing date is now delayed to July 15th;

- 2019 taxes owed and 2020 first instalment date is delayed now to July 15th;

- IRA contributions are extended to July 15th;

- 10% penalty for early withdrawal from an IRA or 401(k) is waived;

- Taxes on IRS withdrawals can be paid over 3 years, or an individual can re-contribute within 3 years;

- Mortgage relief for homeowners: forbearance can be obtained for up to 360 days

- Deferral of student loan payments to September 30th, no interest accruing;

- Payroll tax relief and employee retention tax credits are available

- Small business loans of up to $10M; non-refundable to the extent of 8 weeks of payroll, rent and utilities

- State relief may differ from the Federal relief packages, so State implications should be reviewed

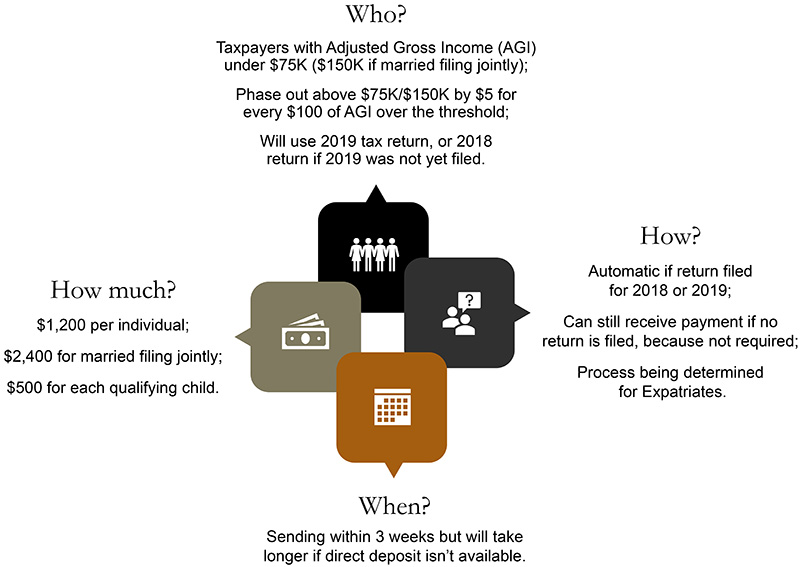

ECONOMIC RECOVERY CHEQUES

For U.S. citizens living in the U.S. or living abroad, the process is as follows:

The information in this article is meant to be general in nature; please contact your accountant for specific details related to your personal situation. Comments are based on current law and IRS policy, which are subject to change. Any opinions related to U.S. Tax Policy, risk of non-compliance, and other political views are solely of the author and do not represent the opinions or views of Richter LLP as a whole.