Survey Of Bank Forecasts – March 2020

World markets tank on concerns over the novel coronavirus COVID-19 pandemic, as central banks counter with extraordinary stimulus measures and governments brace for a possible economic reset.

Much of what was reported on was published prior to the pandemic really ramping up. Information may have since been revised. As the situation changes now almost day-by-day, major banks and reserves continue to adjust accordingly.

Global stock markets react to the coronavirus pandemic

One of the largest selloffs in stock market history started the last week of February fueled by concerns over the extensive economic impact of the COVID-19 pandemic. The DJIA dropped from 28,795.5 on February 24th to close at 19,898.9 on March 18th, showing a decline of 30.9%, while the TSX Index fell 33.92% from 17,748.66 to 11,727.99 in the same time frame. In Europe, the UK FTSE fell from 7,151.00 to 5,041.57 and the German DAX Index dropped from 13,370.24 to 8,400.32, showing respective declines of 35.1% and 37.2% for that period.

BOC and Fed cut interest rates amid Coronavirus crisis and stock markets crash

The Bank of Canada’s (BoC’s) Governing Council cut the Overnight Rate by 50 basis points on both March 4th and March 13th, leaving it currently at 0.75%. The move followed similar cuts by other leading central banks and was taken in response to the serious macroeconomic impact of the COVID-19 outbreak and to shore up crashing stock markets.

On March 15th, the BoC joined the Bank of England (BoE), the US Federal Reserve, the Bank of Japan (BoJ) and the Swiss National Bank (SNB) in a coordinated action to provide liquidity through established USD liquidity swap line arrangements. The BoC stated it would release a full update — including its outlook for the economy and inflation — at the next rate decision on April 15th. In a press conference on March 18th,[1] BoC Governor Poloz also announced the broadening of the Canadian government’s bond buyback program, adding new term repo operations and introducing a new Bankers’ Acceptance Purchase Facility to begin on March 23rd.

In an unprecedented move after an emergency meeting on Sunday, March 15th, the US Federal Open Market Committee (FOMC) slashed the Federal Funds Rate to 0-0.25% from 1.00%-1.25% and announced it will buy $700 billion in Treasury and mortgage-backed securities. The Fed stated it will hold rates low “until it is confident that the economy has weathered recent events and is on track” to achieve its goals. Additional U.S. stimulus packages are presently being debated at both the state and federal government levels.

On March 17th the Fed announced the establishment of a Primary Dealer Credit Facility (PDCF)[2] to support the borrowing needs of U.S. households and businesses. The PDCF becomes available on March 20th for six months and will offer overnight and term funding with maturities of up to 90 days. On March 19th,[3] the Fed also announced the establishment of swap lines with certain other central banks to provide further global liquidity, including liquidity of up to $60 billion for the central banks of Australia, Korea, Mexico, Brazil, Singapore and Sweden and up to $30 billion for the New Zealand, Norwegian and Danish central banks.

On March 6th, Statistics Canada reported a 0.1% monthly increase to the Canadian Unemployment Rate to 5.6%, despite the addition of 30.3K full-time jobs in February. The agency’s website says it plans to continue releasing “mission critical” data essential to the proper functions of the Canadian government and economy to deal with the current crisis but will be postponing all other data releases until further notice.

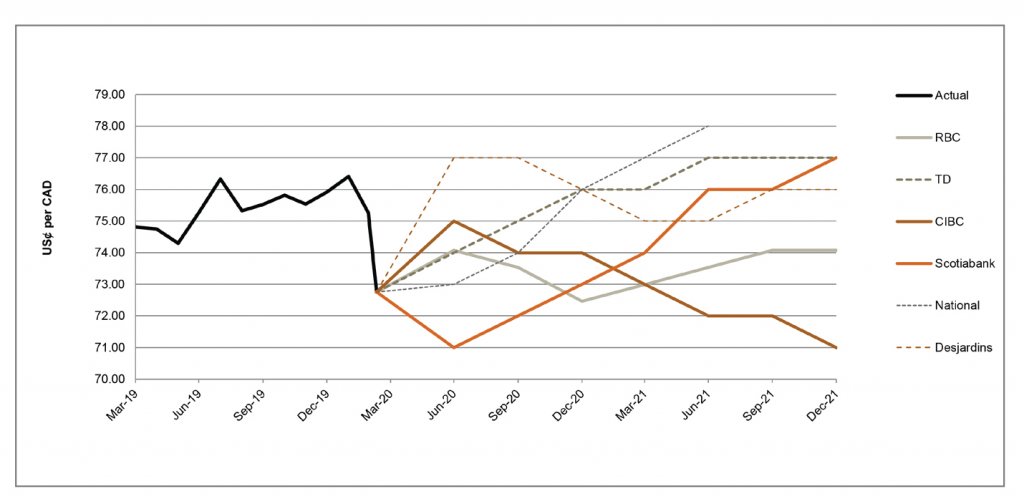

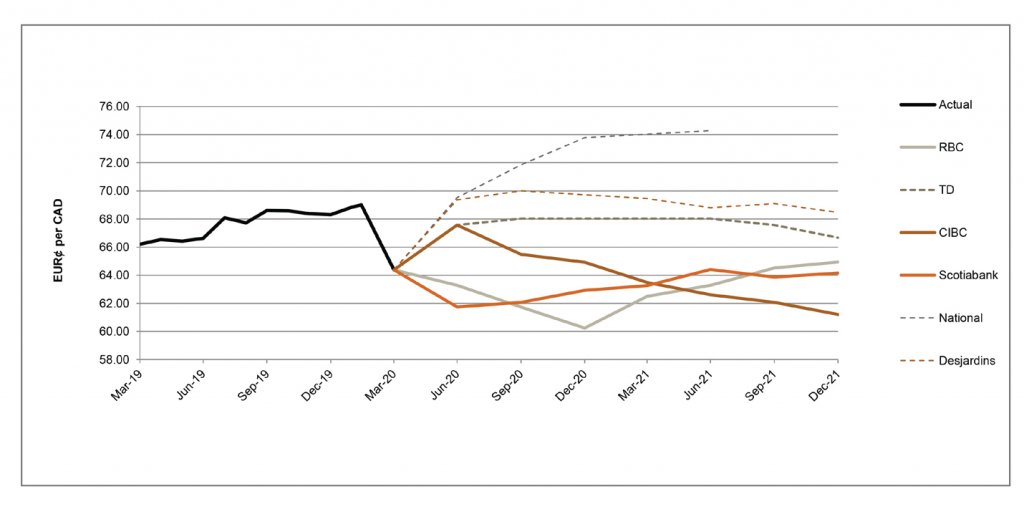

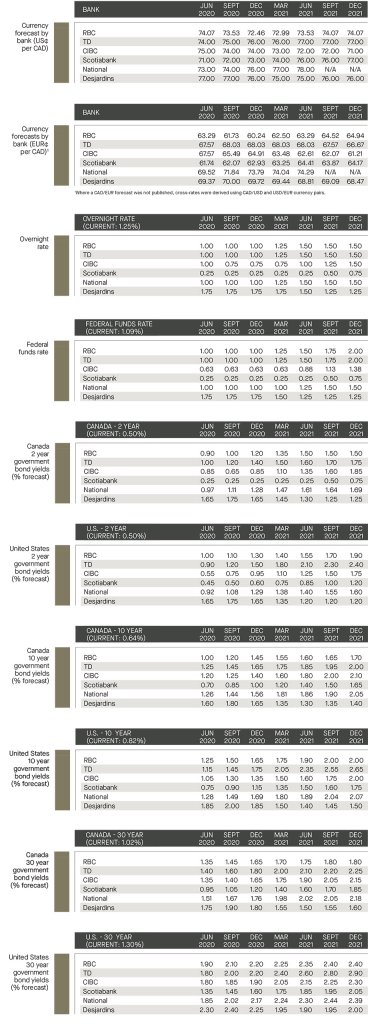

Due to the effects of the COVID-19 outbreak that sparked a notable rise in risk aversion and a sharp drop in the price of oil that remains one of Canada’s key exports, the Canadian dollar weakened significantly versus the US dollar to trade as low as 0.6826 on March 18th. Of banks surveyed, the Canadian dollar was expected to trade between 0.7140 and 0.7300 (Scotiabank), 0.7300 to 0.7400 (CIBC), and 0.7246 to 0.7463 (RBC) during 2020, but the lower side of each range has now already been breached, so those forecasts will be revised lower.

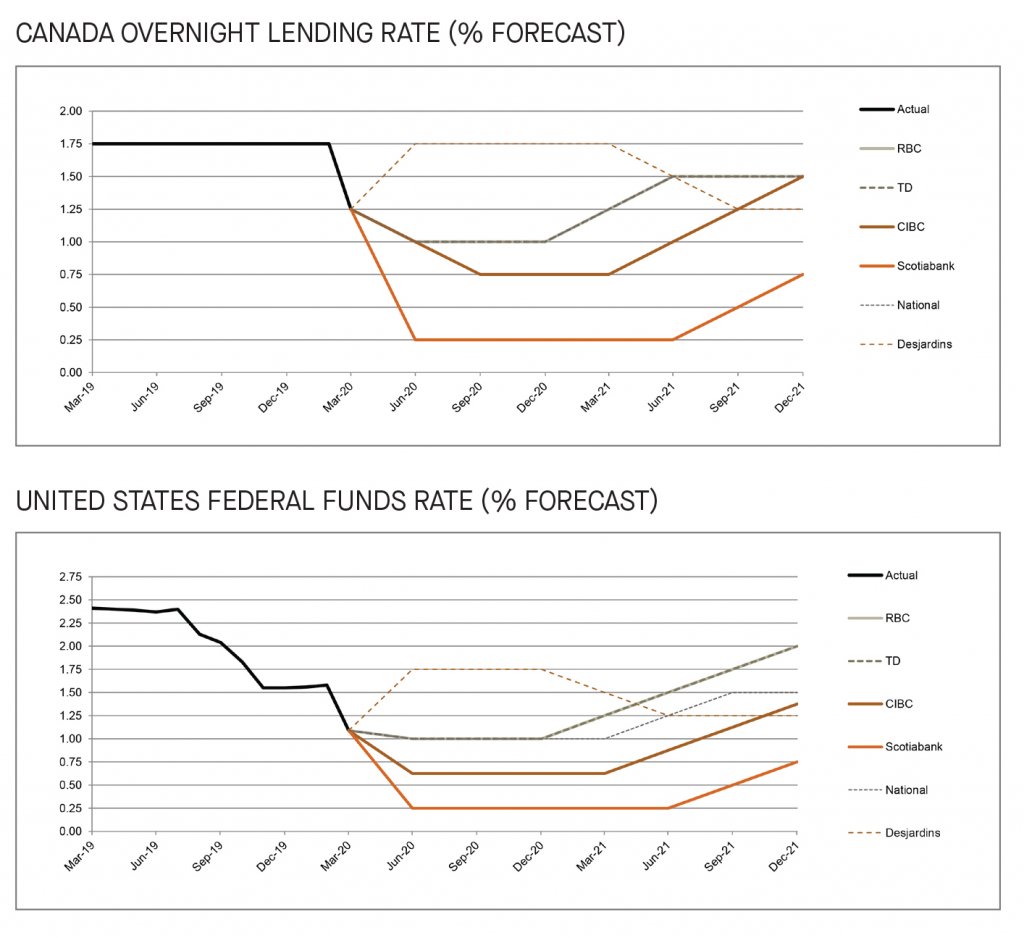

BoC and Fed interest rate forecasts

In a press conference on March 18th, BoC Governor Poloz told reporters that, “The Bank of Canada is taking concerted action to support the Canadian economy during this period of economic stress. We have introduced these new measures and we are watching how market performance improves. We are closely monitoring market developments and we stand ready to provide all the liquidity the financial system needs so that it can continue to serve Canadians.”

Writing before the most recent emergency Overnight Rate cut on March 13th to 0.75% from 1.25%, RBC forecast the benchmark rate would decline to 1.00% by Q4, while CIBC expected a drop to 0.75% and Scotiabank predicted a decline to 0.25% by Q2 of 2020.

Speaking on March 15th after the FOMC drastically cut the Fed Funds Rate to 0.0%-0.25% from 1.00%-1.25%, Fed Chair Powell stated that, “We are prepared to use our full range of tools to support the flow of credit to households and business, to help keep the economy strong, and to promote our maximum employment and price stability goals.” Banks surveyed before that surprise move already expected the FOMC to lower rates for the remainder of the year, with Scotiabank projecting 0.25%, CIBC estimating 0.625% and National forecasting 0.75%, although those forecasts will probably soon be revised lower.

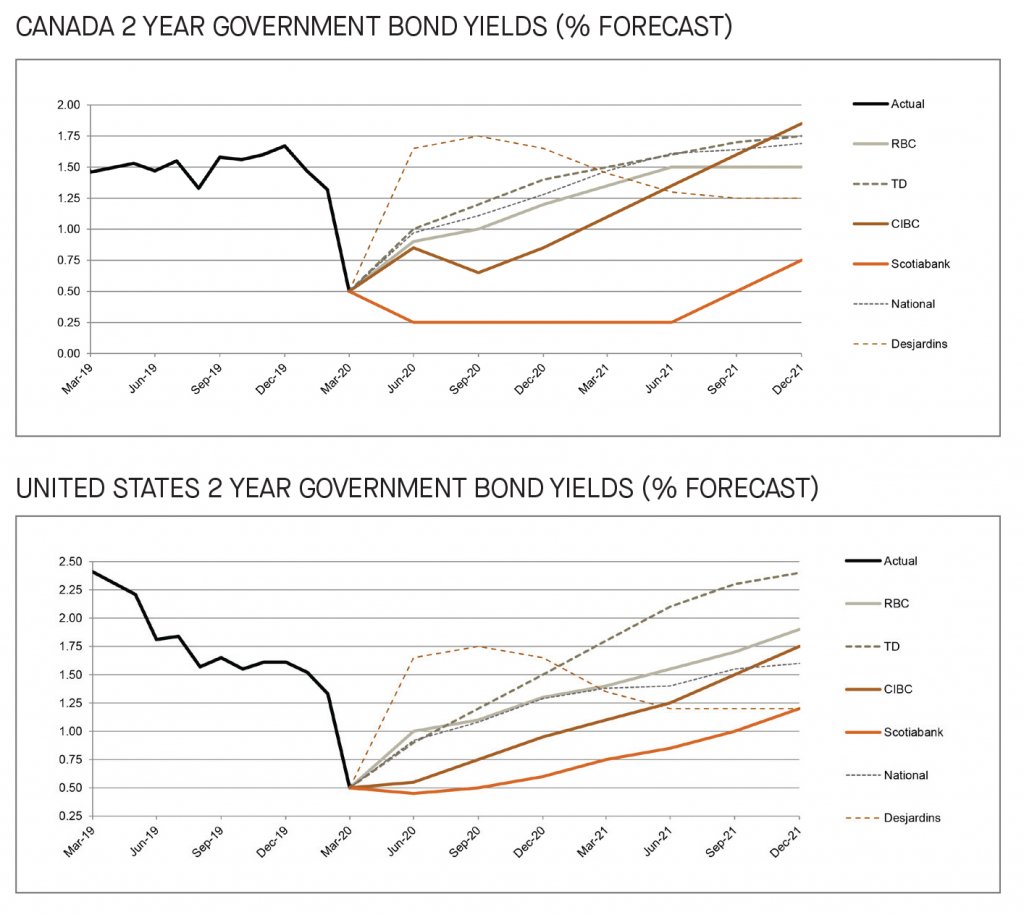

2-year bond yields forecast to rise in the US and Canada

US and Canadian 2-year government bonds currently yield 0.483% and 0.69% respectively. Most surveyed banks had expected higher yields than those before recent emergency benchmark rate cuts in both countries due to the COVID-19 situation resulted in an unexpected drop in yields. Bank surveys of 2-year government bond yields made prior to the current pandemic emergency were: US 1.29% and Canadian 1.09% (National), US 0.95% and Canadian 0.85% (CIBC), US 1.58% and Canadian 1.70% (RBC), and both US and Canadian 1.75% (Desjardin).

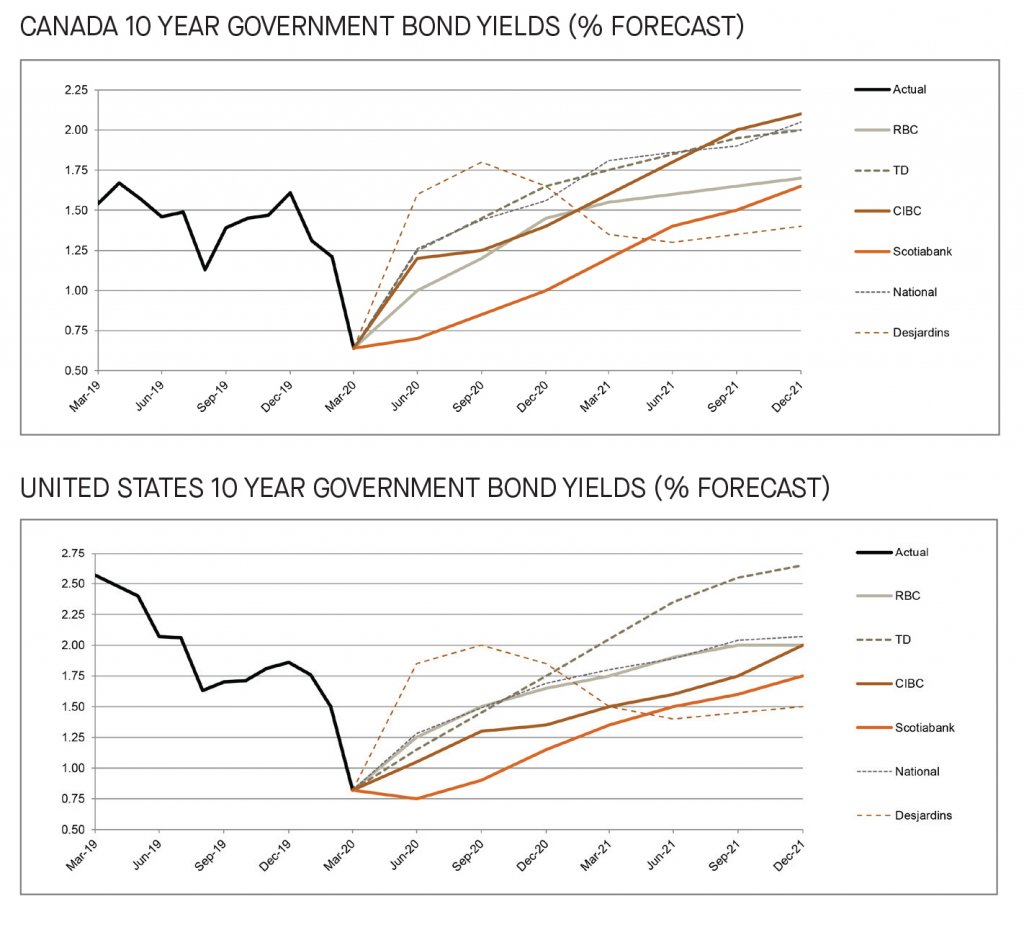

10-year bond yields for US and Canada were expected to rise beginning in Q1 2020

US and Canadian 10-year government bonds currently yield 1.151% and 1.002% respectively. Prior to the present pandemic emergency, Desjardin expected an increase in the US 10-year bond yield to 2.0% and 1.80% for the Canadian 10-year by Q3 2020, while National Bank of Canada expected the yield to rise to 1.69% for the US 10-year and 1.56% for the Canadian 10-year by Q4 of 2020. CIBC called for a yield of 1.35% for the US 10-year and 1.40% for the Canadian 10-year by Q4 2020, while Scotiabank expected Canadian and US 10-year yields to remain steady at 1.00% and 1.15% respectively.

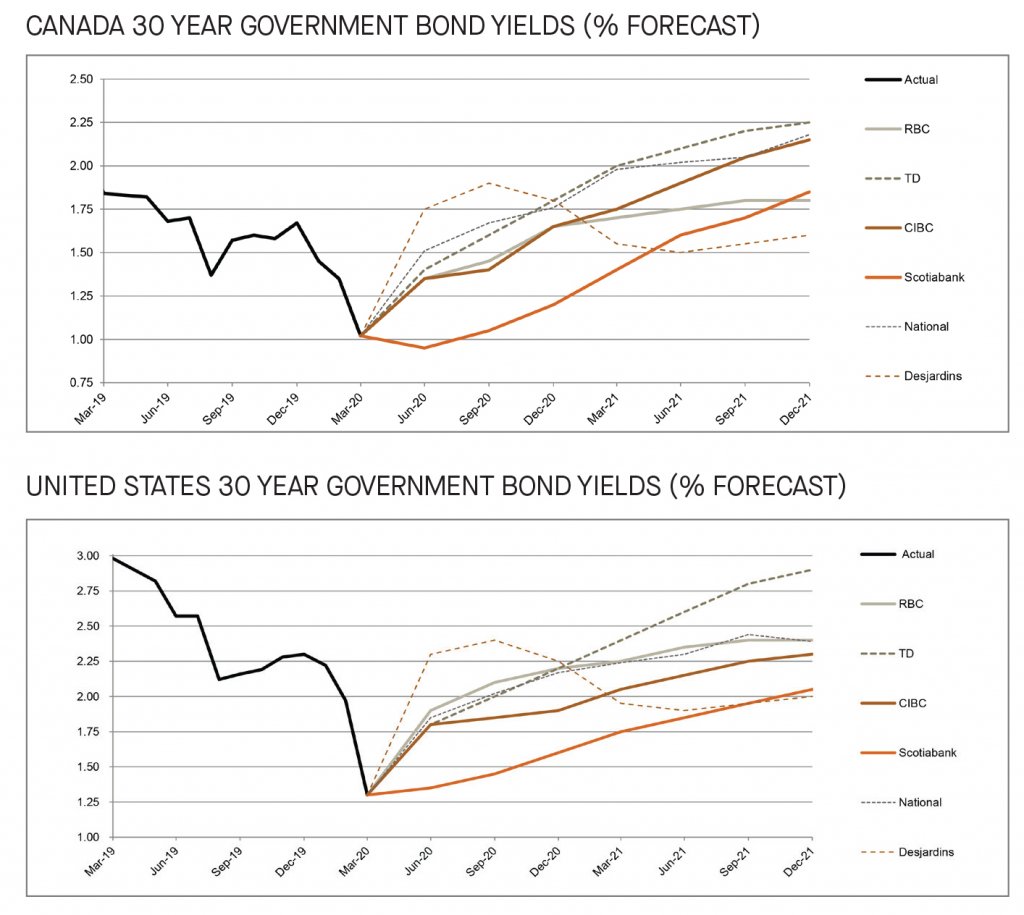

30-year bond yield forecasts were mixed among the surveyed banks

US and Canadian 30-year government bonds currently yield 1.783% and 1.426% respectively, and before the COVID-19 pandemic, surveyed banks showed mixed expectations for both countries’ 30-year bond yields by the end of 2020. Specifically, National expected 2.17% for US and 1.76% for Canadian yields, while Scotiabank expected 1.60% for the US 30-year and 1.20% for the Canadian 30-year, Desjardins forecast 2.25% and 1.80% for the US and Canadian 30-year respectively, CIBC expected 1.90% and 1.65% for the US and Canadian 30-year respectively, and RBC forecast 2.20% and 1.65% for the US and Canadian 30-year bond yields.

[1] https://www.federalreserve.gov/newsevents/pressreleases/monetary20200317b.htm

[2] https://www.bankofcanada.ca/2020/03/opening-statement-180320/

[3] https://www.federalreserve.gov/newsevents/pressreleases/monetary20200319b.htm