SR&ED tax credits: How your daily business activities could yield major tax returns

Many companies from various industries are often unaware that through their daily activities, they perform scientific research and experimental development (SR&ED).

- Are you in a start-up or growth phase?

- Have you developed some form of customized equipment or machinery?

- Have you created or modified a process or product?

- Are you planning to change an existing process or develop a new product in the near future?

- Have you tried to create a new product, process, or technology but failed in the attempt?

If you answered yes to one or more of these questions, your company could be eligible to federal and provincial SR&ED tax credits!

What are SR&ED tax credits?

SR&ED tax credits are fiscal measures through which the federal and provincial governments reimburse investments in innovation. Millions of dollars are allocated annually to these programs to foster innovation. Last year, 24,000 companies in Canada claimed such tax credits, among which 75% are SMEs.

How much can you get?

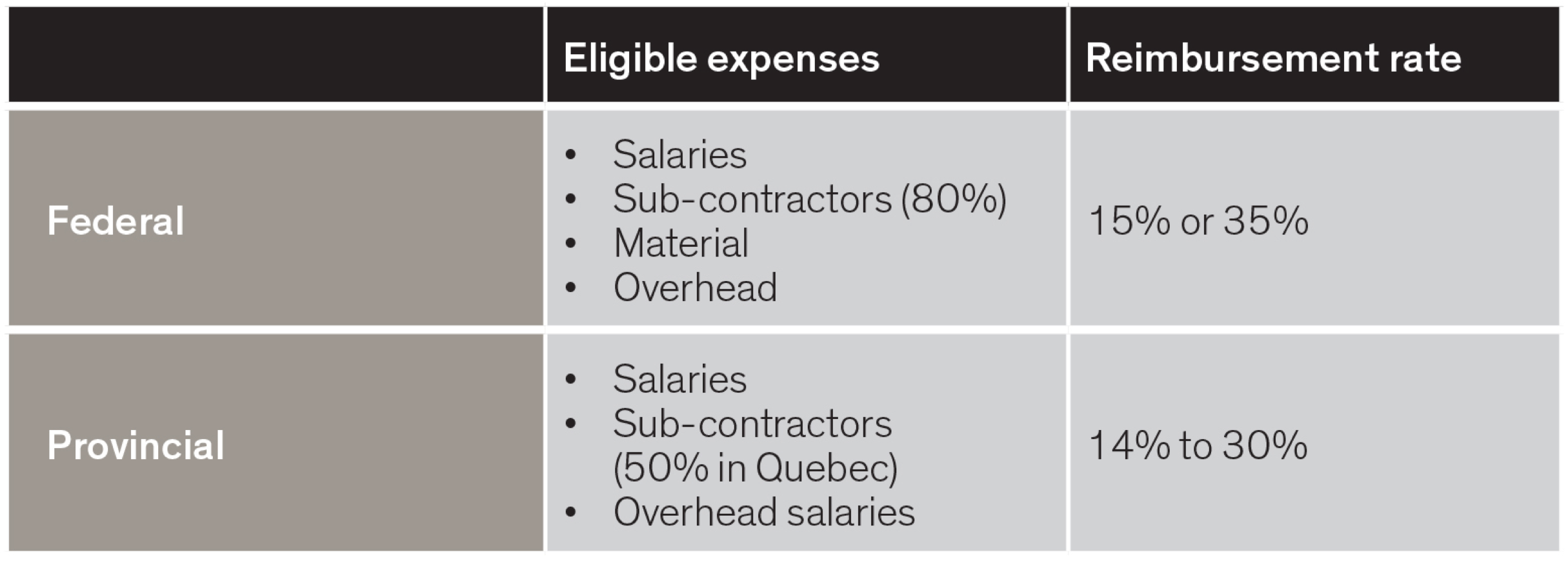

The amount of tax credits you can get depends on the expenses incurred for the development (or failure ) of your new process, product, or technology.

Rates

Do you qualify?

To assess your SR&ED tax credits claim and determine its eligibility, the CRA uses five questions:

- Was there a scientific or a technological uncertainty?

- Did the effort involve formulating hypotheses specifically aimed at reducing or eliminating that uncertainty?

- Was the overall approach adopted consistent with a systematic investigation or search, including formulating and testing the hypotheses by means of experiment or analysis?

- Was the overall approach undertaken for the purpose of achieving a scientific or technological advancement?

- Was a record of the hypotheses tested and the results kept as the work progressed?

If the answers to these questions are positive, SR&ED may be right for you!

Other tax credits

Some projects may have components that qualify for multiple tax credits: the E-Commerce tax credit (Crédit d’impôt pour le développement des affaires électroniques), the tax credit for the production of multimedia titles, or the Design tax credit (Crédit d’impôt pour la réalisation d’une activité de design à l’interne). The Ontario government also offers specific tax credits for digital media and innovation. While you are allowed to claim different tax credits for the same project, all claims must be related to different elements of the project. Since you cannot claim multiple credits for a single expense, you should take time to determine which fiscal program will generate the most beneficial return.

Stay focused on your business

While it is possible to manage the filing of a SR&ED tax credit claim internally, we strongly recommend using the help of seasoned professionals for this process. The Richter team has gained the experience to ensure that your returns are maximized and that no expenses are left unclaimed. Our professionals will also accelerate the CRA approval process and significantly increase your claims’ success rate. Fiscal planning and administrative paperwork will be taken care of, meaning you can stay focused on what matters most: your business.