Sale of a business: How to prevent small details from turning into big obstacles

A competitor or a private equity firm is knocking on your door, offering millions of dollars for your business. What do you do? Naturally, if this ties into your business strategy, you jump at the opportunity and immediately ask the potential buyer to sign a letter of intent to ensure that the principal parameters of the considered sale will be respected. You then begin to think about what you will do with your millions…

However, what you haven’t planned for is that after six months of due diligence work, numerous meetings (with management, bankers and other stakeholders) and complete mental exhaustion, the transaction falls through, despite the fact that you had a signed letter of intent.

What happened?

What factors can derail a transaction?

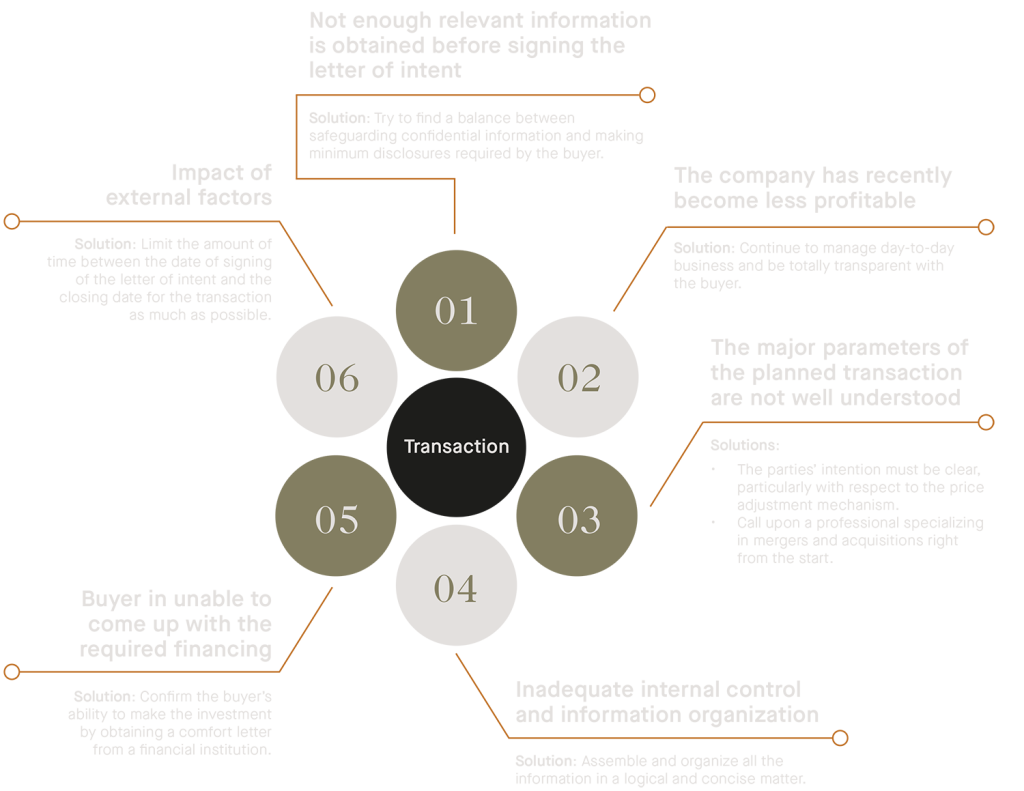

Many factors can hinder the realization of a transaction after the signing of the letter of intent. Here are six risk factors that may cause the transaction to fall through, as well as the possible ways to mitigate each of them.

Risk factor #1: Not enough relevant information is obtained before signing the letter of intent

Information that should be obtained or confirmed in advance includes, amongst others:

-

- The most recent financial statements, adjusted EBITDA calculation;

-

- Sales volume by customer (customer concentration risk with one or a few customers);

-

- Purchase volume by supplier (supplier concentration risk with one or a few suppliers);

-

- Overview of the quality of the assets (e.g. age of accounts receivable, inventory and equipment quality, recent investments in fixed assets) as well as the required reinvestment, which may have a significant impact on the company’s ability to generate cash flows after the transaction.

How to secure the transaction

-

- A balance must be found between safeguarding the seller’s confidential information and disclosing enough information in order to obtain a credible and sufficiently detailed letter of intent from the buyer.− Sign a confidentiality agreement.

-

- Opt for a two-part process for the sale of a business:− Obtain a letter of expression of interest from several potential buyers that sets out the key financial parameters of the transaction which are based on relevant information that can be disclosed without undermining the company’s competitive position (e.g. sales volume, EBITDA, balance sheet, etc.). It is beneficial to target buyers who are likely to meet the needs expressed by the seller.− After selecting a limited number of buyers which respect his needs, the seller should provide additional relevant information to the select group of potential buyers in order to obtain a detailed letter of intent (offer letter).

Risk factor #2: The recent deterioration of the company’s profitability

A gradual deterioration in the company’s performance in the months leading up to the transaction versus the level of performance presented during price negotiations, can affect the success of the transaction.

How to secure the transaction

-

- The entrepreneur must continue to manage the day-to-day business while making decisions in keeping with the business model. The focus will therefore remain on the company’s profitability, which can help protect the seller against a potential price decrease and the risk of the transaction falling through; two very costly outcomes.

-

- If the company’s performance differs substantially from what was shown in the most recent annual financial statements, the seller should quickly address the issue with the buyer to avoid any surprises.

Risk factor #3: The major transaction parameters are misunderstood

It is crucial that both parties and their legal advisors understand the accounting and financial

mechanics of the transaction. The following issues must be discussed:

-

- What is the buyer acquiring and what liabilities are being assumed?− Does the cash free, debt free concept apply?− Is the buyer assuming some or all of the company’s debts (bank debt, long-term secured loan, subordinated loan, etc.) as part of the transaction? If applicable, it should be specified which debts are being assumed by the buyer and which are being settled by the seller.

-

- The method to calculate the price adjustment at the transaction date, as set out in the letter of intent; e.g. adjustment of non-cash working capital1 to take into account the impacts of seasonality on the company’s monthly working capital.

-

- The calculation of the contingent consideration, or earn-out, if applicable.

How to secure the transaction

-

- The parties’ intentions must be clearly reflected in a sample calculation of the formula stipulated in the agreement. This example could be based on the financial statements provided by the seller.

Risk factor #4: Inadequate internal control and information organization

We refer here to a company that does not have monthly financial statements, qualified personnel to answer all of the buyer’s questions and/or who has difficulty in organizing information in a structured manner.

-

- Strong internal controls make it possible for the seller to provide comprehensive information, facilitate the buyer’s due diligence process and boost the level of trust between the buyer and the seller.

-

- Weak internal controls renders the due diligence process difficult for the buyer.

How to secure the transaction

It is important to prepare the appropriate financial information from the onset of discussions regarding the transaction process (e.g. monthly financial statements, a list of contracts signed with customers and suppliers as well as other major contracts, a list of movable and immovable property, etc.).

It is crucial to present all this information in a well-structured manner, logically and concisely, before initiating the transaction process. To do so, it is recommended to prepare an outline for the electronic data systems to be used, gather key documents and ensure all of the appropriate information is up-to-date.

Risk factor #5: Buyer cannot raise the required financing

This might happen in the following situations:

-

- The buyer is contemplating an over-leveraged financial structure for the transaction.

-

- The company operates in an industry segment where lenders are more risk-averse (e.g. the garment industry, restaurants).

How to secure the transaction

-

- Request a term sheet from the financial institution that confirms the financing being offered.

-

- Ensure that the buyer has secured the necessary financing for the transaction (adequate down payment) and that the company’s quality of earnings has been rigorously assessed in order to reasonably estimate the capacity for financial leverage.

-

- Before the letter of intent is signed, it is recommended that the buyer be required to disclose certain information in order to confirm that he is capable of realizing the transaction (e.g. history of relationship with the lending institution, credit quality).

Risk factor #6: External factors

External factors may impact the sale in the following situations:

-

- Regulatory changes (government tax credits, permits, etc.);

-

- Changes in economic outlook;

-

- Changes in the buyer’s strategic objectives.

How to secure the transaction

Limit the amount of time between the date of signing of the letter of intent and the closing date of the transaction. Once the letter of intent has been signed, the price can only go down – which is why it is a good idea to do everything possible to conclude the transaction as quickly as possible!

How to make sure that the transaction goes through :

Get the help you need to ensure the transaction will go through

Although having a signed letter of intent is crucial for a transaction to be realized, a number of critical factors must be considered before breaking out the champagne. Be aware of a letter of intent proposing conditions that are too good to be true. In such situations, expect that the potential buyer will want to renegotiate some major conditions following the due diligence process.

When preparing a transaction, it is crucial to be accompanied by an expert who will help you mitigate the risks of the transaction falling through. From the onset of the process, call upon the services of a professional with merger and acquisition experience to ensure that the seller makes the most of his bargaining power during negotiations and that any issues are discussed ahead of time – not one week before the closing date.

It’s also of the utmost importance for the seller to analyze all the information and seek further assistance from a financial consultant with business acquisition experience in order to adequately prepare for the due diligence review. In so doing, the seller can anticipate confidently any questions the buyer may have.

If proper steps are taken and underlying risks have been avoided, then by all means, pop the bubbly and cheers to you on the big transaction!