Five Tax Tips for Canadian Businesses Venturing into the U.S.

Are you prepared to face the IRS?

Have you filed all the proper forms? Do you know which forms to submit and when? Did you know that the Canadian-U.S. tax treaty can prevent double taxation and save you money? If you have answered ‘no’ to one, any, or all these questions: don’t worry.

The truth is, cross-border tax between Canada and the U.S. is an intricate process… After all it involves two federal governments, treaties, and state and provincial jurisdictions. And while all this can seem daunting at first, “forgetting” to file your taxes, filing them improperly or refusing to file them can result in hefty penalties. Furthermore, not being aware of the treaties in place can leave you paying more taxes than you should. Which is why we’ve prepared a list of tax tips to keep in mind when doing business in the U.S. Due to the complex nature of some of these rules, readers are urged to seek out Richter professionals so that the impact of tax consequences regarding the readers’ specific situations can be properly interpreted.

Always start with tax planning and compliance

Tax planning ensures the maximization of a business’s after-tax earnings: tax efficiency and optimization of a global effective tax rate. An effective tax plan considers business operations and tax implications for all types of corporate structures. When doing business in the U.S., tax planning experts can determine if a business is subjected to the Canada-United States Convention with Respect to Taxes on Income and on Capital (aka the Canada-U.S. tax treaty). The Canada-U.S. tax treaty has a double objective of helping companies avoid double taxation and prevent fiscal evasion. But there’s a catch, not every state in the U.S. follows the treaty! Some states have their own laws regulating taxes on income and capital, which is where the compliance work comes into play.

Compliance work is essential because it helps to ensure that all the right forms are completed and documented properly depending on the jurisdiction. It’s also a continuous process which allows your advisors to monitor and adjust your transfer pricing policy (read: which can help you manage where you pay taxes, when and how much) on an ongoing basis. Another factor that determines the amount of taxes your company might pay in the U.S. is your corporate structure… So, follow on to point #2!

Consider your corporate structure

Choosing the right corporate structure depends on the needs of the company as well as the needs of the individual owners. It’s also a great way to minimize overall taxes. Tax implications change according to the chosen structure. For example: while a branch is not a separate legal entity, a branch will be subject to tax as if it was a separate tax entity, with the taxes paid for by the branch’s owner. Technical interpretations of the Canada – U.S. tax treaty demonstrate that some form of a “fixed place of business” is required for a branch to exist. In addition to corporate income taxes, a Canadian owner of a U.S. branch will be subject to the U.S. branch profit’s taxes on profits deemed repatriated from the U.S. branch.

It may be necessary or beneficial for business reasons and for tax planning reasons to run the foreign business in a separate corporation rather than as a branch. In this case, the newly incorporated entity will pay its own corporate income taxes separately. Funds repatriated by the Canadian owner from the U.S. corporation will be subject to U.S. dividend withholding taxes which are payable by the U.S. corporation.

It’s important to note that as a business grows and expands, the corporate structure can change to fit the new reality of the business: and (you guessed it) such change could trigger different tax considerations. In all cases, transfer pricing guidelines must be adhered to when transacting with a foreign branch or a related foreign corporation, and taxes on repatriation of funds must be factored into the analysis.

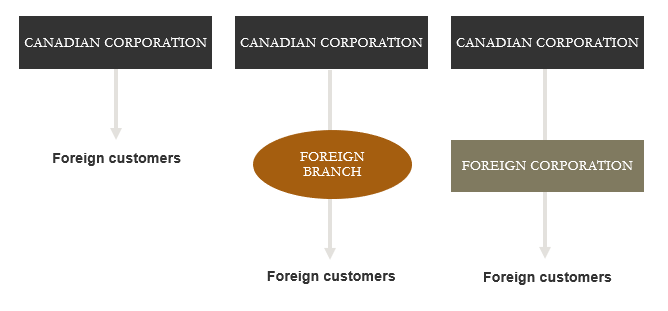

Among a multitude of possible cross-border corporate structures, there are three basic structures that stand out as shown in the diagram below. Evaluating which is best for your current situation is best done with your Richter professional:

Recognize key differences between federal and state laws and taxes

At the Federal level under the Canada-U.S. tax treaty, a Canadian business is only taxable in the U.S. on its U.S. business profits if it has a U.S. permanent establishment through which it carries out business (a branch, an office, a factory, an installation or a place of extraction of natural resources, etc.).[1] If your Canadian business serves clients in the U.S. but doesn’t have a U.S. branch or a U.S. corporation, then it might not need to pay federal income taxes. Either way, tax returns must be filed properly.

Michel Oulimar, Senior Manager at Richter, says: “Sometimes clients ask: ‘We have clients in the U.S., but we don’t have a physical presence there, so why should we file a tax return?’ And we always tell them: better safe than sorry. If a company’s particular situation warrants it, we could recommend filing a treaty-based tax return. This return is essentially a nil tax return with some informational disclosures. The return shows the IRS that while the business does have U.S. clients, it doesn’t operate from a permanent establishment in the U.S. and is allowed relief from U.S. federal tax under the terms of the Canada-U.S. tax treaty.” Filing this return is especially important because the IRS has three years after a tax return is filed to review it. Beyond three years from the date of filing, it becomes increasingly difficult for the IRS to challenge the treaty relief position taken. If no tax return is filed, not only is there no limit to the period of time the IRS can assess taxes, the IRS can require a business to pay up to 30% of gross revenue plus interest for each year that a tax return was not properly filed. Further, failing to enclose the right forms and documentation with the tax return can result in an additional penalty fee of $10,000 USD per year.

At the state level, states can impose a tax on income of businesses that have sufficient connection or presence in said state (“nexus”). Relief from such taxes is not necessarily available under the Canada-U.S. tax treaty. Nexus can be established by doing business in the state, having a physical presence in the state, or having a minimum threshold of sales to customers in the state. All these criteria vary by state. Once nexus is established, the state can tax the company’s income allocated to that state based on the state’s rules. Further, the state could also require the company to collect and remit state sales tax.

Sales taxes only apply at the state level in the U.S. and they vary from 2% to 9% depending on the state. As of 2018, a physical presence in the state is no longer required to perceive sales taxes. The U.S. Supreme Court ruled that states can require online retailers to collect sales taxes from their customers and remit these taxes to the state, even if the business doesn’t have a physical presence in the state. This applies to businesses that make at least 200 transactions or have sales totalling at least $100,000 USD in the state per year. If the online retailer fails to collect the taxes from its customers, that retailer will be responsible to pay theses taxes.

Keep in mind transfer pricing

Transfer pricing requirements cannot be ignored considering aggressive auditing by tax authorities to ensure that intercompany transactions are priced at market value. In other words, it’s important to prove to the CRA and IRS that your company’s intercompany transactions’ prices are based on similar transactions done between unrelated companies, (this principle is referred to as the arm’s length transaction rule). To justify your company’s prices, you need to present appropriate transfer pricing documentation.

Olivier Djoufo, Manager at Richter, says: “The critical zone for a company is when you reach $1,000,000 CAD of intercompany transactions. Once a company’s $1,000,000 CAD threshold is passed, the company must submit the appropriate form called a “T106 Information Return of Non-Arm’s Length Transactions with Non-Residents”. It’s important to complete the T106 form properly, because if not, a taxpayer can be subject to heavy penalties both for the non-production of the T106 form and for transfer pricing revenue adjustments – in this case transfer pricing penalties can go up to 10% of your adjusted income. And that’s another way Richter can help. Our understanding of U.S. and Canadian tax regulations allows us to provide advice on transfer pricing compliance and audits. With our expertise we can identify and support the implementation of the most suitable transfer pricing policy and offer guidance to help navigate complex transfer pricing requirements.”

Transfer pricing can also be regarded as an opportunity to structure international operations in a tax-efficient manner. This is something worth looking into if you’re thinking of doing business in the U.S. Beyond minimizing tax exposure, transfer pricing can provide useful insights into the business, increase operational efficiency and optimize global tax liabilities.

Seek out a U.S. tax and transfer pricing expert

We know this is a lot of information, especially considering that laws and tax regulations can change over time depending on many factors, such as global pandemics, political climates, and new technologies, to name a few. You might wonder where to begin? Working with a tax professional can help you demystify the regulations that apply to you and your company and keep you updated on the legislation from both the U.S. and Canada. Suffice to say, adequate tax planning and proper handling of tax issues can help with your company’s growth and financial gains. Knowing when to reach out to a tax professional for help is the ultimate key to seamlessly navigating the world of international taxes. At Richter, our expertise is unique in that our experts are adequately positioned to understand both the U.S. and the Canadian side of tax regulations. Through strategic reviews and tailored advice, our experts can help you minimize your taxes, meet compliance requirements and improve your company’s overall tax position.

The information in this article is meant to be general in nature; please contact your Richter professional for specific details related to your situation. Comments are based on current law and IRS policy to date, which are subject to change. Any opinions related to U.S. Tax Policy, risk of non-compliance, and other political views are solely of the author and do not represent the opinions or views of Richter LLP as a whole.

[1] Article V. Convention Between Canada and the United States of America. https://www.canada.ca/en/department-finance/programs/tax-policy/tax-treaties/country/united-states-america-convention-consolidated-1980-1983-1984-1995-1997.html