Fall Economic Statement 2020 (Federal)

Similar to our previous releases, we have chosen not to summarize all tax measures proposed in this year’s 2020 Fall Economic Statement and instead highlighted what we believe to be most important for you.

INCOME TAX

1) Stock Options

- The 50% federal tax deduction on stock option shares will be limited to those shares having a maximum value of $200,000 at the time the options are granted. This measure will be applicable only to non-CCPC employers with annual gross revenues in excess of $500 million.

- Employers will be able deduct the amount of any stock option benefit included in an employee’s income where the stock option deduction is limited

- The new rules will apply to stock option agreements entered on or after July 1st, 2021.

2) Home Office Expense Deduction

- Employees working from home in 2020 due to COVID-19 will be entitled to claim up to $400 of home office expenses without having to track specific expenses. More details will be communicated in the coming weeks.

3) The Canada Child Benefit (CCB) top-up

- As of 2021, the CCB will be subject to tax free top-up payment of between $600 and $1,200 per child for families with children under the age of six.

4) Home Energy Retrofits

- Starting December 1, 2020, a grant of up to $5,000 will be available to homeowners who make energy-efficient improvements to their homes as well as free EnerGuide energy assessments.

GOVERNEMENT PROGRAMS (COVID-19)

5) Canada Emergency Wage Subsidy (“CEWS”)

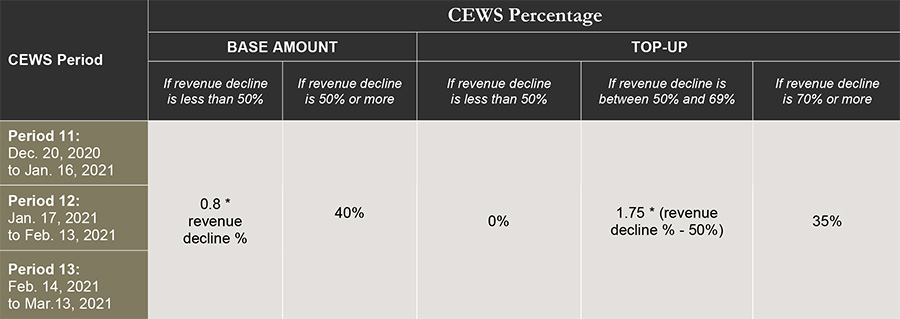

- Program details have been released until March 13, 2021. The amount that can be claimed under the CEWS continues to be calculated based upon the revenue decline of the business, detailed in this table:

- Effective December 20, 2020, a business must continue to use the same comparative benchmark they used from Period 5 (beginning on July 5, 2020) onwards.

- Support for furloughed employees has been extended until March 13, 2021 and can reach up to $595 per employee, per week.

6) Canada Emergency Rent Subsidy (“CERS”)

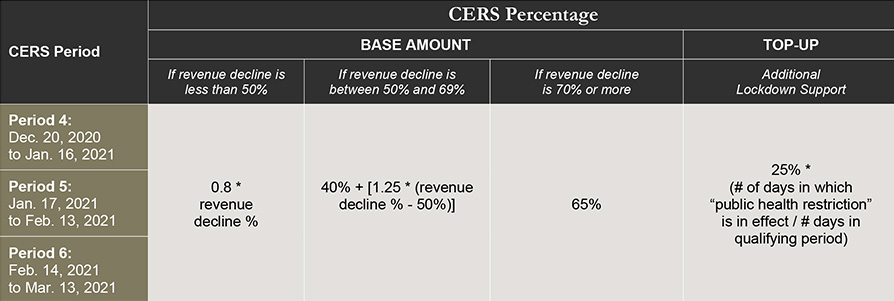

- The framework detailed in our previous release has been extended until March 13, 2021. Specifically, the amount that can be claimed under the CERS continues to be calculated based upon the revenue decline of the business detailed in this table:

- A business must continue to use the same comparative benchmark they used for prior CERS periods which, would be the same as the comparative benchmark for CEWS used from Period 5 (beginning on July 5, 2020) onwards, if the CEWS was claimed.

7) Canada Emergency Business Account (“CEBA”)

- Non-interest bearing loans granted under CEBA will be increased by up to $60,000. Where a certain amount of the loan is repaid on or before December 31, 2022 will result in loan forgiveness of up to $20,000. More details will be communicated at a later time.

- Applicants now have until March 31, 2021 to submit an application for CEBA.

SALES TAX

- Effective July 1, 2021, new GST/HST registration and collection requirements will apply to:

- Foreign-based vendors selling digital products or services to consumers in Canada, and

- Digital marketplace platforms (including digital platforms offering short-term accommodation).