In the news | Espace | Alana Geller | Private company compensation in the real estate industry

Part 1: Aligning compensation with corporate and ownership objectives

A decade or two ago, the idea of allowing employees to participate in the equity growth of privately held and often family-owned real estate businesses was almost preposterous. Those that adopted this practice were seen as avant-garde or sometimes imprudent – and generally did so only for long-tenured, trusted and very senior employees, if at all. Based on our experiences, owners against this practice cited:

- Complex ownership and family dynamics

- Complicated share ownership structures

- Fear that plans may impact tax optimization for the owners and their families

- Privacy issues

- Lack of liquidity for the shares

- Conflicts of interest

- Lack of necessity to do so and/or felt it was too complicated to implement

While many real estate business owners still hold some of these sentiments, the tides are changing. Private businesses are seeing the benefits of adding equity or equity-like programs to their compensation structures or at least are considering these programs to compete for top talent. Additionally, short-term discretionary bonuses are being swapped in favour of more robust programs with clear targets and measured results.

A well-designed compensation program including base salary and employee incentives [short-term incentive plans (STIP) and long-term incentive plans (LTIP)] will assist private businesses in the same way as public and institutionally backed entities have done for a long time. Incentivizing key talent to achieve corporate and ownership objectives, while ensuring market competitiveness, offers many benefits that the private sector can no longer overlook.

Nature of the Business and Strategy

The most effective plans are tailored to your business and consider corporate and ownership objectives. Prior to undertaking changes to your compensatory programs, it is wise to ensure that your ownership objectives are aligned with your corporate strategy. Owner and business objectives evolve over time and as such, these objectives and related effective compensation programs should be revisited and refined as needed.

Some considerations include:

- Nature of business: Incentive structures may vary if the business is based on asset holding, development, service-based or otherwise.

The nature of the business will impact the employees selected to participate, duration of the plan, timing to receive the rewards and other factors such as the use of performance hurdle rates. For example, asset holder owners should be weary of employees benefiting simply from market lift which is not correlated to any specific business-related success. Performance hurdle rates that reference the performance of peer groups or other market factors can be effective tools to mitigate this risk. Performance hurdles can also be integrated for development and service-based businesses.

- Asset classes and asset-specific risks: Incentive structures are often similar across asset classes (i.e. residential, retail, office, etc.), but the key performance results are likely to be very different based on asset class cyclicality and asset-specific performance.

Core real estate strategies (i.e. acquisition and management) generally have lower incentive pay compared to value-add strategies (i.e. acquisition with some improvement). Moving along the risk continuum, opportunistic strategies (i.e. land development, substantial repositioning) usually see the highest proportion of total compensation as incentive pay. These trends reflect the risk inherent in the strategies.

- Strategy, business lifecycle and key objectives: Incentive structures and related key performance indicators will vary depending on the business’s overall strategic direction, including if the business is targeting growth, maintenance or divestment.

For a business with high growth aspirations, providing employees with a mechanism to share in the growth through a LTIP can be helpful to align corporate, ownership and employee interests. If the business generates a high amount of cash flow, it may be appropriate to share with employees on an annual basis. In contrast, if the business needs to reinvest its cash, the plan terms should be aligned and not payout cash flow until some logical milestone is met.

For a business looking to sell or wind down its holdings, incentives related to maximizing value in the short- to medium-term will be more appropriate, and retention bonuses may be considered to ensure leaders remain in-place to execute the strategy.

Human Capital Strategy and Compensation Objectives

Each private real estate business or family office with real estate investments should specifically outline its human capital strategy and compensation objectives. The following will apply to most of these entities:

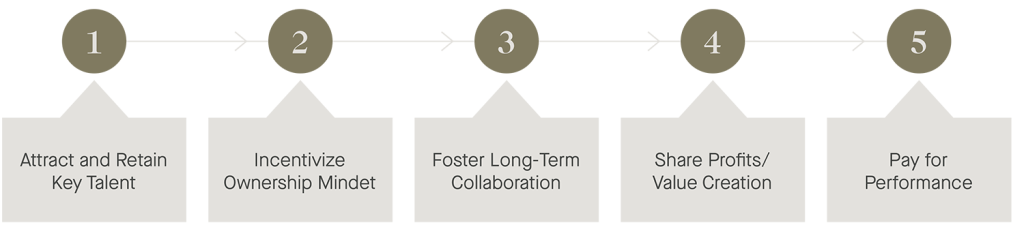

Compensation Strategy Key Objectives:

- Attract and retain key talent: Many private real estate businesses of sufficient size are competing with public and institutionally backed organizations for the same talent pool. These competing firms offer short-term and long-term incentives which are effective tools to attract, retain and motivate the workforce.

- Incentivize ownership mindset: Well-designed incentive plans will encourage a culture of accountability, openness, engagement, communication and empowerment. These attributes often lead to higher morale, passion and drive to achieve corporate and ownership goals.

- Foster long-term collaboration: The past decades in the real estate industry in Canada have seen:

-

- Growth and diversity of teams

- Increase in virtual work environments

- More complex organizations and corporate goals

Each of these factors increase the importance of collaboration. Individual and divisional performance remains important, but there is renewed focus on collaboration across organizations, particularly at the senior leadership level.

While compensatory programs in isolation do not necessarily foster collaboration, well designed incentive plans often promote discipline to clearly communicate and measure corporate goals, coupled with a culture of feedback and knowledge sharing for private businesses. These factors result in a collaborative ‘rowing the boat together’ mentality to achieve corporate and ownership goals.

- Share profits / value creation: Many real estate organizations are focused on increasing profit metrics and creating value over the long-term. Incentive plans which align these corporate goals with employee goals are likely to benefit from these practices over the short- and long-term.

- Pay for performance: In many private real estate businesses, we have witnessed a shift from an emphasis of rewarding tenure and loyalty to rewarding employee contribution to business success. This creates opportunities for high performers to progress quickly and earn compensation commensurate with their contribution to the organization’s objectives.

For private businesses that are highly reliant on talent, employee incentive plans are powerful tools that are becoming more prevalent and critical to attract and retain talent. A tailored and thoughtful incentive plan will inspire leadership teams, benefiting the owner families intergenerationally. Such plans strengthen the succession plan and foster the achievement of ownership and corporate strategy and goals. With many real estate investors undertaking or preparing for an intergenerational ownership transfer, getting a stronghold on management succession and key talent is more paramount than ever before.

This article is part one of a two-part series. Our next article will outline key considerations of performance-based incentives including participants, value/cash flow to be shared, vesting, valuation and other matters.