COVID-19: Important Changes to the Canada Emergency Wage Subsidy (“CEWS”) Program

On July 27, 2020, the federal government enacted several important changes to the Canada Emergency Wage Subsidy (“CEWS”).

In particular, the changes enable any employer with a revenue decline for any reason to be eligible for the subsidy for the periods beginning July 5, 2020. As well, the changes provide for a subsidy which likely is less generous than under the old regime (applicable from March 2020 to June 2020). The program has also been extended until November 21, 2020, and the deadline to apply for any or all CEWS periods is now January 31, 2021.

Due to the complex nature of these rules, readers are urged to seek out their Richter professionals so that their impact can be properly evaluated and that their revenue decline analysis and wage subsidy calculations can be properly determined.

Measuring Revenues and Expansion of Revenue Decline Test

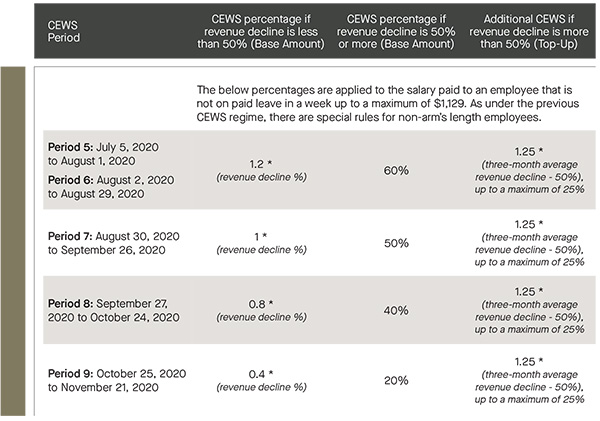

- Under the new regime, the amount that can be claimed under the CEWS is calculated based upon the revenue decline of the business, as follows:

- As an alternative, if a business is better off under the old regime, they can continue to benefit from those rules for the periods beginning July 5, 2020, and August 2, 2020.

Other Changes to the CEWS Program

- Entities that do not use GAAP as their normal accounting method can elect to use GAAP when computing revenues for the purpose of the CEWS.

- Effective July 5, 2020, a business may continue to use the same comparative benchmark they used under the old regime, being a comparison to the same month in 2019 or a comparison against the average revenue for January and February 2020. However, effective for the period beginning on or after July 5, 2020, a business can switch their choice of comparative benchmark on a go-forward basis, which may represent an opportunity for some businesses.

- Effective July 5, 2020, if the prior monthly revenue decline is greater than the revenue decline of the month in which the claim is being made, the revenue decline of the prior month will be used in order to determine the CEWS percentage, which will result in a greater CEWS claim.

- Effective July 5, 2020, the concept of “eligible employee” no longer excludes employees that are without remuneration in respect of 14 or more consecutive days in an eligibility period.

- The concept of “baseline remuneration” has been modified in a manner that may be helpful if an employee was not receiving salary from January to March 2020 but was receiving salary in 2019.

- Effective July 5, 2020, the subsidy calculation applicable to employees on paid leave has been modified and may represent an opportunity to retain employees, even if a full workforce is not required on or after July 2020.

- CEWS is now available where the employer’s payroll is administered by another person and the source deductions are remitted under that person’s business number.

- CEWS may now be available where all or substantially all of a business’ assets were acquired from another business.

- Rules were introduced to ensure CEWS is available in certain circumstances where an amalgamation has taken place.

- The anti-avoidance rule has been extended to encompass actions taken to increase a CEWS payment by way of increasing a revenue decline in relation to periods beginning July 5, 2020, and onwards.

- Private schools or colleges which are either a registered charity or exempt from income tax will be able to exclude funding from government sources in the determination of qualifying revenue.

- A dispute resolution mechanism has been introduced.

Additionally, we have prepared a table to assist you in navigating the old and new rules, determining eligibility and calculating CEWS.