Commercial Due Diligence

Commercial Due Diligence is part of Richter’s suite of integrated transaction advisory services, helping buyers validate their investment hypothesis and understand the attractiveness of a business. Commercial Due Diligence supplements a buyer’s Financial Due Diligence (“FDD”, or Quality of Earnings) to ensure a Target’s outlook is supported by structural market attractiveness, a means of competitive differentiation, and realistic business model assumptions.

What is Commercial Due Diligence?

Commercial Due Diligence (“CDD”) is a critical piece that helps financial buyers and private equity investors make informed investment decisions, proactively identify potential risks and value creation opportunities, and optimize returns. When exploring new markets, platform investments, and even significant strategic bolt-on acquisitions, independent specialists conduct CDD to provide the necessary industry expertise, deal team capacity, and external strategic perspectives.

In general, a commercial due diligence reviews a Target’s strategy and commercial assumptions in the context of market conditions, the competitive landscape, customer perceptions, and the Target’s internal capabilities. In turn, it allows investors to understand revenue and profitability projection feasibility, key assumption reasonability, and clarify competitive advantages and disadvantages. Additionally, this process is critical to identify and validate post-close value creation initiatives and net-new growth opportunities alongside immediate investment evaluation and risk identification. There is a risk of an unsuccessful acquisition, or one that does not align with the , if a CDD is not done correctly (or at all).

Benefits of Commercial Due Diligence

- De-Risk Investment

- Ensure Deal Thesis & M&A Strategy Alignment

- Identify / Validate Value Creation Initiatives

- Identify Net-New External Growth Opportunities

- Provide Market & Competitive Intelligence

- Enhance Negotiation Position

Richter’s Commercial Due Diligence Approach

The following triggers indicate when to conduct this level of additional assessment if commercial due diligence is not already part of a buyer’s investment process:

- Uncertain, unsubstantiated, or unclear revenue assumptions;

- Volatile industry dynamics (i.e., market, regulatory, competitive);

- Entry in an adjacent or new industry segment from your core business and portfolio;

- Material investment with a deal thesis highly predicated on active value creation and organic growth.

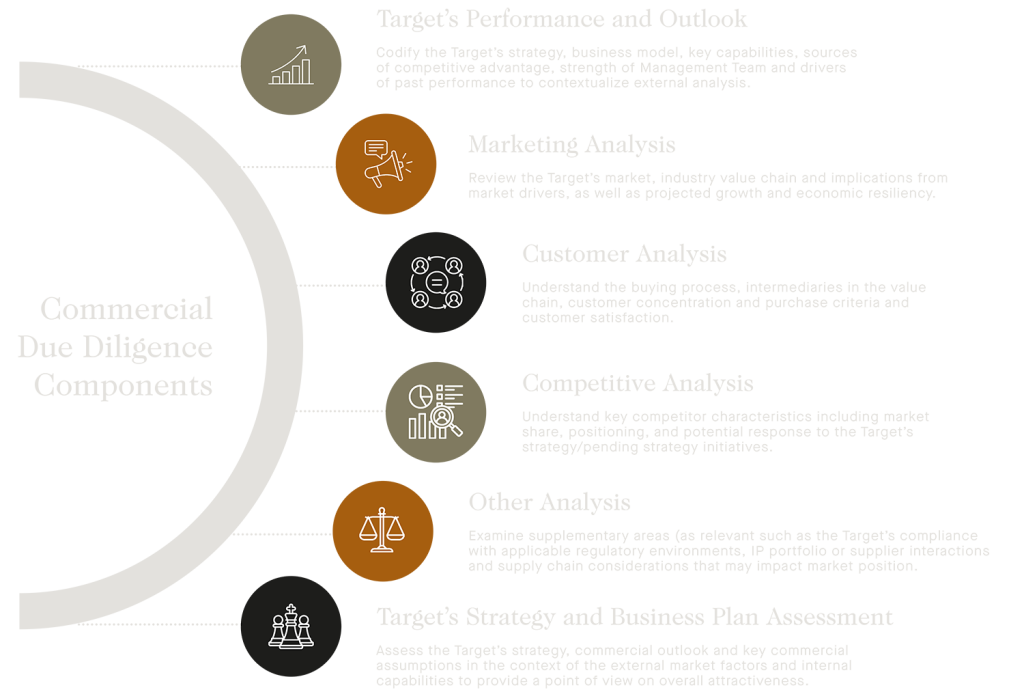

Richter’s commercial due diligence services focus on six main areas to understand a Target’s attractiveness and positioning in the market:

The Richter Advantage – Integrated Due Diligence

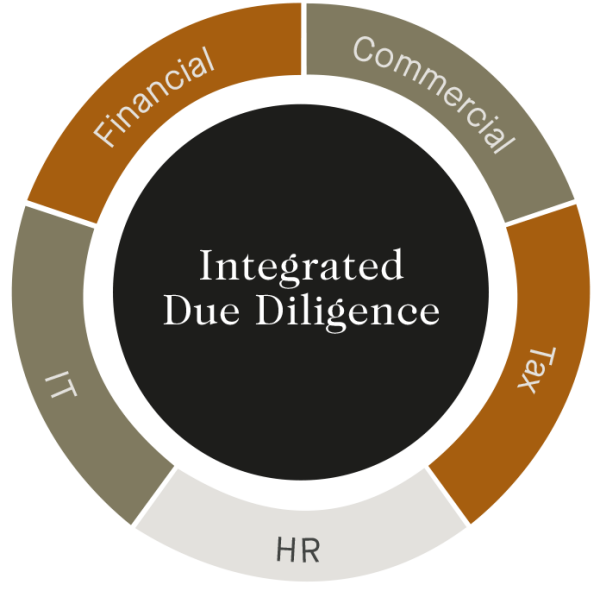

As a Business | Family Office, Richter provides comprehensive transaction support to meet the diverse needs of increasingly complex deals. In addition to commercial due diligence, our cross-functional approach includes:

- Financial due diligence: Analysis of a Target’s financial performance, financial position, and prospects.

- HR due diligence: Review of a target’s human capital assets including talent, compensation, culture, organizational structure, workforce, and HR policies and processes.

- IT due diligence: Review of a target’s technology function including people, process, technology (systems / infrastructure), cybersecurity, data, and IT in-flight initiatives.

- Tax due diligence: Review of a target’s tax environment to determine if any tax exposures exist.

An integrated approach tailored to suit the specific needs of the buyer and deal / Target scenario provides incremental value through:

- Increased confidence / risk mitigation

- Increased efficiency / fewer advisors

- Expanded post-close value creation view

- Coordinated and consolidated reporting