In the news | Espace | Harvey Sands and Audrey Mercier | Understanding New and Important Implications for Major Tenants

Audrey Mercier, CPA, CA, CFE, CFF

Vice-President, Audit

Harvey Sands, CPA, CA, ICD.D

Partner, Audit

As originally appearing in Espace Montreal, volume 26.

The International Accounting Standard Board (“IASB”) and the Financial Accounting Standard Board (“FASB”) have jointly issued a new accounting standard for leases. This new standard will be applicable to all public companies and publicly accountable entities effective January 1, 2019.

This new standard will require that most leases be capitalized and presented on the balance sheet as a right-of-use asset and lease liability. This is a major change from current practice which allows a large portion of leases to be used as a form of off balance sheet financing. Entities with large numbers of leases such as retailers, telecommunications entities, financial institutions, insurance companies, government agencies and other large public companies will be significantly impacted. Impacts will include significant financial statement adjustments which could have a material effect on their financial covenants with their lenders, bondholders, equity owners and landlords.

Real estate companies that are lessors will not be impacted by this new standard given that lessor accounting was not changed. However, they will be indirectly impacted in their dealings with their tenants. As tenants prepare and plan for these changes, landlords and brokers need to understand these issues. Those who plan properly will benefit from competitive and reputational advantages.

Although the majority of leasing decisions are not driven purely by accounting objectives, companies are likely to consider the accounting impact when determining their real estate policies and when finalizing lease contracts. As a result, it is important to understand the upcoming changes to the lease in order to assist in lease negotiation.

Summary of new requirements

Before examining the specific impacts on lease negotiation, it is necessary to provide a high-level overview of the changes.

Lessee accounting

All leases result in the lessee obtaining the right to use an asset at the start of the lease and, if lease payments are made over time, also obtaining financing. Accordingly, the new standard eliminates the classification of leases as either operating leases or finance leases as was previously required and, instead, introduces a single lessee accounting model similar to our old finance leases model. Applying that model, a lessee is required to recognize assets and liabilities for all leases with a term of more than 12 months, unless the underlying asset is of low value. More specifically, on the balance sheet, the lessee will recognize a lease liability and a right-of-use asset at the start of the lease.

The lease liability will be measured at the present value of the future cash payments under the lease. The future cash payments will include:

- fixed payments,

- variable payments that depend on an index or rate,

- amounts expected to be payable under a residual guarantee,

- payments of penalties for terminating the lease, and

- payments under a purchase option that the lessee is reasonably certain to exercise.

The period to be considered in the calculation is the non-cancellable period of the lease plus any options to extend the lease term that the lessee is reasonably certain to exercise. The future cash payments will be discounted using the interest rate implicit in the lease (if readily determinable) or the lessee’s incremental borrowing rate.

The right-of-use asset will be measured at its cost. The cost of the right-of-use asset will include the amount at which the lease liability is recognized, payments made before the lease contract commenced, any initial direct costs and costs to be incurred at the end of the lease to restore the lease asset to a specific condition.

On the income statement, throughout the lease term, rent and lease expenses will now be replaced with depreciation of the right-of-use asset and interest expenses on the lease liability. The depreciation will be recognized on a straight-line basis, while the interest will be a front-loaded charge. The front-loaded expense pattern may average out across a portfolio of leases in a large, stable business. However, there may be significant effects in aggregate for a growing business or a business undertaking a major refresh of its portfolio of leased assets.

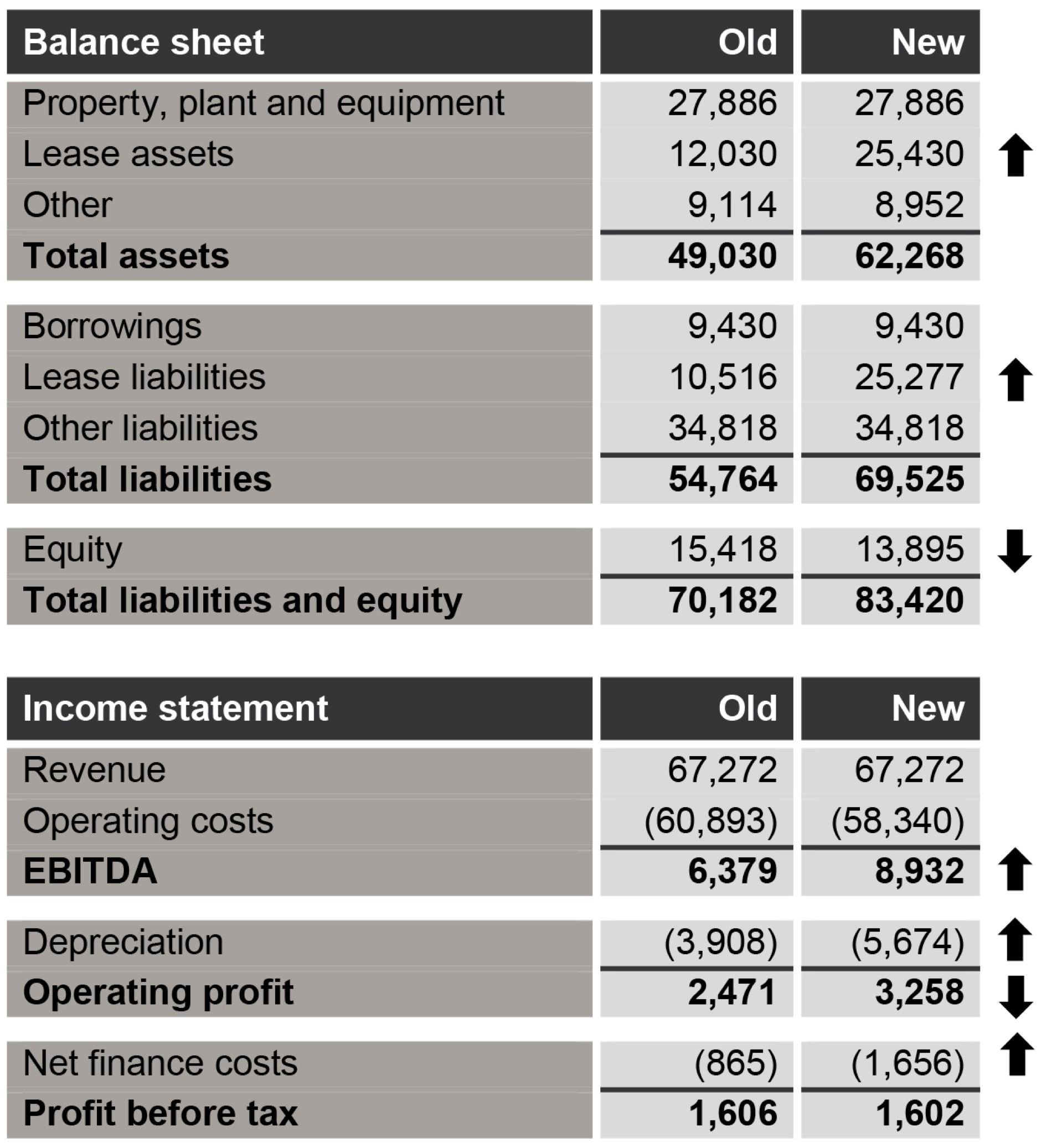

The illustrative example below presents the impact of the new standard on the balance sheet and income statement of a given company:

Lessor accounting

Lessor accounting is substantially unchanged by the new standard. Lessors will continue to classify their leases as operating or financing leases and to account for those two types of leases differently.

Impact on lease negotiation

Owning vs leasing

With the new accounting standard, the difference between leasing and owning property will be reduced as both will result in a liability on the balance sheet. While individual companies may reassess the benefits of leasing versus owning assets, the practical benefits of leasing assets such as operational flexibility, regular payments and a reduction of the obsolescence risk will remain.

On an individual basis, companies that have traditionally entered into long term lease contracts or that lease business critical assets may choose to move to owning the asset, given that the benefits of operational and occupational control may outweigh the accounting benefits under the new standard.

Overall, we do not expect a significant move away from leasing. However, the terms and conditions of leasing contracts may be modified to minimize the impact of the new standard.

Lease term

The magnitude of the lease obligation recognized on the balance sheet will be directly linked to the non-cancellable term of the lease. The non-cancellable term is generally defined as the minimum fixed lease term and options that are reasonably certain of being exercised.

Accordingly, lessees will need to balance the potential of reducing the balance sheet liability through shorter lease terms with the benefits coming from longer fixed lease terms of occupational security, reduced rental market risk, and a longer period for depreciating capital costs.

Incentives

The definition of lease payments excludes lease incentives such as rent free periods and tenant inducements. These incentives will decrease the lease obligation recognized on the balance sheet and the lease payments recorded in the income statement. It is also important to note that this positive accounting impact is greater than an equivalent rent reduction over the full lease term. Therefore, under the new standard, we expect that lessees will favor upfront lease incentives over incentives blended over the lease term.

Fixed and variable payments

The definition of lease payments excludes certain variable payments, such as, for example, variable payments determined by the amount of sales from a leased store. This has a clearly positive effect on the lease liability recognized on the balance sheet and the lease payments recorded in the income statement which will both be based on the fixed rent element only. Given this advantage, we expect lessees to request variable lease payments (also called “turnover related rent payments”) wherever possible. For retailers in particular, this will be a good way to minimize the impact of the new standard.

Lease and non-lease components within a contract

Some lease contracts include both a lease component and a service component (ex. maintenance). The service component is accounted for separately from the lease component and does not have to be included in the lease obligation on the balance sheet. This will require allocating payments between the lease and service elements. Lessees may request that lessors assist them by separately pricing the non-lease components to help them evaluate and minimize the financial statement impact. Lessors are likely to be reluctant to disclose this information for proprietary reasons.

Subsequent rent reviews

Several leases contain rent review mechanisms to adjust to market prices. The following three common mechanisms exist:

- Index-linked payments (ex. annual CPI increase)

On day 1, the lease obligation and the lease payments will be calculated based on the assumption that the future payments will be at the current rent. - Market rent reviews (ex. 5-year upward only market review)

On day 1, the lease obligation and the lease payments will be calculated based on the assumption that the future payments will be at the current rent. - Fixed increases (ex. 2.5% annually)

On day 1, the lease obligation and the lease payments will be calculated considering all future increases which increases the lease liability and the lease payments recognized.

Consequently, leases with index-linked or market reviews will have lower lease liabilities on the balance sheet and lower lease payments on the income statement. However, these leases will need to be reassessed each time the lease payments will change which will increase the accounting burden. Overall, we expect that the choice between these mechanisms will be driven by business and operating reasons rather than accounting rational and will vary from market to market.

Sale and leasebacks

Sale and leasebacks are currently a common method of raising capital “off balance sheet”. By selling an asset to a real estate company and leasing the asset back at an agreed rent, financial statements show improved equity and reduced debt.

Under the new standard, this method will no longer offer “off balance sheet” financing as a lease liability will need to be recognized. As a result, there will be a reduced accounting benefit to undertaking sale and leasebacks. From an operational point of view this type of transaction will still be valid as an alternative source of financing and will likely still exist; but we expect its use to be reduced.

Conclusion

The new standard represents a significant change in the way leases will be recognized in financial statements. Senior decision-makers are likely to display a renewed focus on lease negotiations due to the potential impact of individual lease terms on their financial metrics. Commercial real estate lessors, brokers and developers will need to be ready to face this new reality. The lessees’ bias for and requests of shorter terms and variable payments may unfortunately result in unpredictable revenue for lessors.

About Richter : Founded in Montreal in 1926, Richter is a licensed public accounting firm that provides assurance, tax and wealth management services, as well as financial advisory services in the areas of organizational restructuring and insolvency, business valuation, corporate finance, litigation support, and forensic accounting. Our commitment to excellence, our in-depth understanding of financial issues and our practical problem-solving methods have positioned us as one of the most important independent accounting, organizational advisory and consulting firms in the country. Richter has offices in both Toronto and Montreal. Follow us on LinkedIn, Facebook, and Twitter.