12 tips for managing your company cash situation

By Simon Lapointe

Financial issues are of critical importance for all entrepreneurs. This is especially true for startups and growth-stage companies, which all too often lack dedicated accounting personnel and do not know where financial management efforts should be focused. Which invoices should be paid first? What is the best way to manage the company’s bank account? How should the company’s budget be planned or organized?

Without sound financial management, a SME may be forced to operate without the personnel needed to ensure its growth, to halt product development and to set aside business development initiatives. It also may be unable to acquire the equipment needed for it to be profitable. This represents a major risk for any SME.

Making each dollar count

Before beginning the succession planning process, certain things must be clarified with your successors and your business advisors. How can you avoid losing your bearings when planning and managing your company’s budget? With a good cash flow management framework. Cash flows refer to a company’s inflows and outflows of money and form the basis of good budget planning. Effective cash flow management allows you to get the most out of every dollar.

In particular, you may:

- Assess your cash resources, plan expenses and analyze needs;

- Optimize your use of cash and ensure that you are able to honour your short-term commitments;

- Calculate your capital burn rate;

- Find new financing sources by making it easier for lenders to commit capital;

Assess whether your projections are accurate by checking your forecasts on a regular basis.

12 tips for managing cash flows

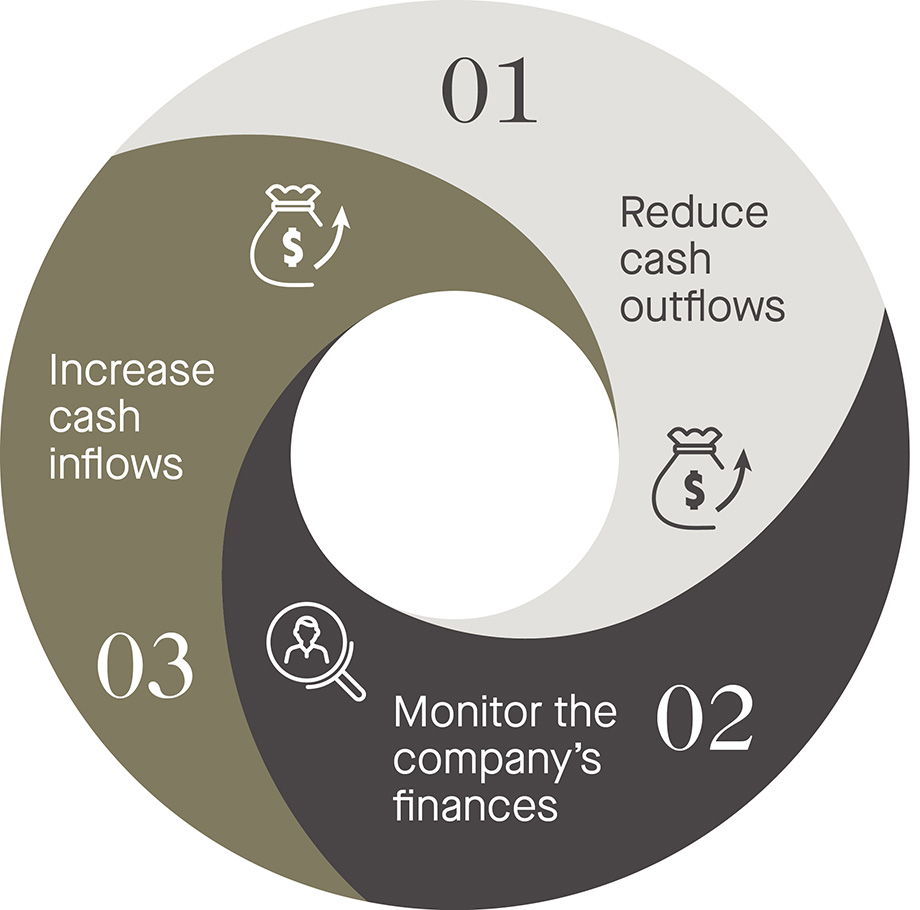

Since you want to squeeze the most out of every dollar, you must structure your cash flows in a way that will allow you to accelerate your cash inflows (revenue and capital) and reduce or postpone outflows (salaries, supplier payments, equipment purchases, etc.), while always keeping an eye on the company’s finances. The following are some tips to help you do this.

Reduce cash outflows

- Use a credit card to pay for liabilities. This gives you an extra month to pay your balance and you will also receive rewards points that can be cashed in ata later time.

- Make sure that you only keep enough inventory to meet customer needs.

Unnecessary inventory can weigh the company down, in addition to resulting in management and storage costs. - Postpone paying creditors.

Many suppliers let you pay within 30 days, sometimes even longer. It is a good idea to use this option when it is available and to negotiate with suppliers that do not offer this possibility. - Structure employee compensation to tie it in with cash inflows.

You can offer employees a lower salary accompanied by short-term bonuses to be paid as objectives are met. A number of different options are available, such as giving employees the opportunity to acquire company shares or paying bonuses when new contracts are obtained or a certain sales volume is achieved. - Lease non-essential equipment.

Leasing allows you to limit major expenses which could hamper the business. Many financial institutions offer finance lease formulas that will allow you to become the owner of the leased property after a certain period of time.

Increase your cash inflows

- Talk to your financial institution to obtain access to short-term funds

(e.g., a line of credit, working capital loan, finance leases, etc.).

Most financial institutions offer flexible financing options. Talk to your account manager to learn about the latest product offerings. - Improve your company’s accounts receivable collection rate.

Provide a discount to customers who pay before the deadline. - Pre-sell products.

Crowdfunding is popular, and for good reason. This allows you to generate revenues before products are even available and to ensure that the company has the capital required for production. Take a look at Kickstarter or La Ruche campaigns. - Leverage all financing solutions.

There are many different grant, subsidy and tax credit programs offered by various institutions. Many are listed on the Canada Business Network website.

Keep an eye on the company’s finances

- Check your forecasts on a monthly or weekly basis.

It is important to keep the company’s books up to date so as to have an idea of the current, or near current, status of the company finances. This allows you to make better decisions based on all available information and to avoid excessive debt. - Focus on the company’s primary activities.

Always give priority to activities that generate—or that will generate—value. Make sure that all of your expenses are necessary and cut those that are not. - Expect to wait for financing.

If your company needs financing, always remember that the process can sometimes be difficult and that funds are not paid immediately after the contract is signed. Always assess your company’s future needs while ensuring sound cash flow management to be able to anticipate and resolve problems as efficiently as possible.

Where to begin?

Implementing processes to manage cash flows can seem complicated at first, but the benefits are worth the effort. An Excel schedule, some discipline and a bit of professional help are enough to transform your business!